Choosing the right accounting software is crucial for managing your business finances effectively. At Allsystems, we offer a curated selection of the top 10 accounting software options, including globally recognized names such as SAP accounting software, Sage accounting software, Xero accounting software, Quickbooks accounting software, Tally accounting software, and Busy accounting software. These platforms are designed to simplify financial processes, from bookkeeping to tax filing and financial reporting.

SAP Accounting Software: Known for its powerful enterprise resource planning (ERP) capabilities, SAP accounting software is ideal for large organizations. It offers advanced tools for financial planning, controlling, and analytics, helping businesses optimize their financial operations across different regions.

Sage Accounting Software: Widely used in Kenya, Sage accounting software provides businesses with comprehensive financial tools, including invoicing, payroll, and tax management. With both cloud-based and desktop versions available, Sage is a top choice for businesses looking for reliable accounting software.

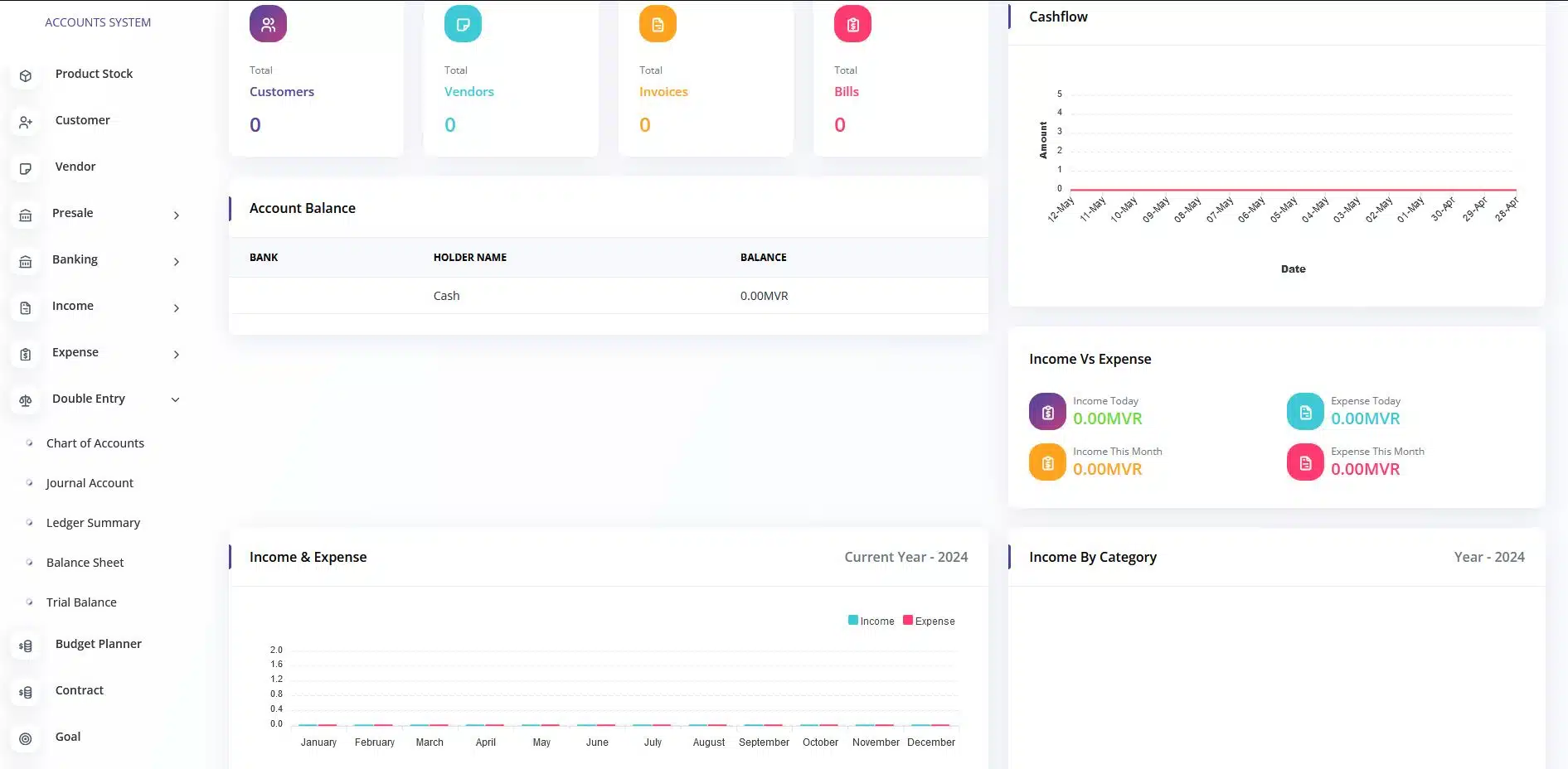

Xero Accounting Software: This cloud-based solution is perfect for small and medium-sized businesses. Xero accounting software offers robust features such as real-time reporting, automated bank feeds, and multi-currency support. It’s an excellent option for businesses in Kenya and throughout East Africa.

Tally Accounting Software: A favorite for small businesses in many African countries, Tally accounting software is known for its simplicity and versatility. It offers features like inventory management, payroll, and tax calculations, making it an affordable solution for growing businesses.

Zoho Accounting Software: Zoho provides an intuitive interface and is widely praised for its affordability and ease of use. Zoho accounting software is suitable for startups and small businesses looking for an efficient way to manage finances, track expenses, and send invoices.

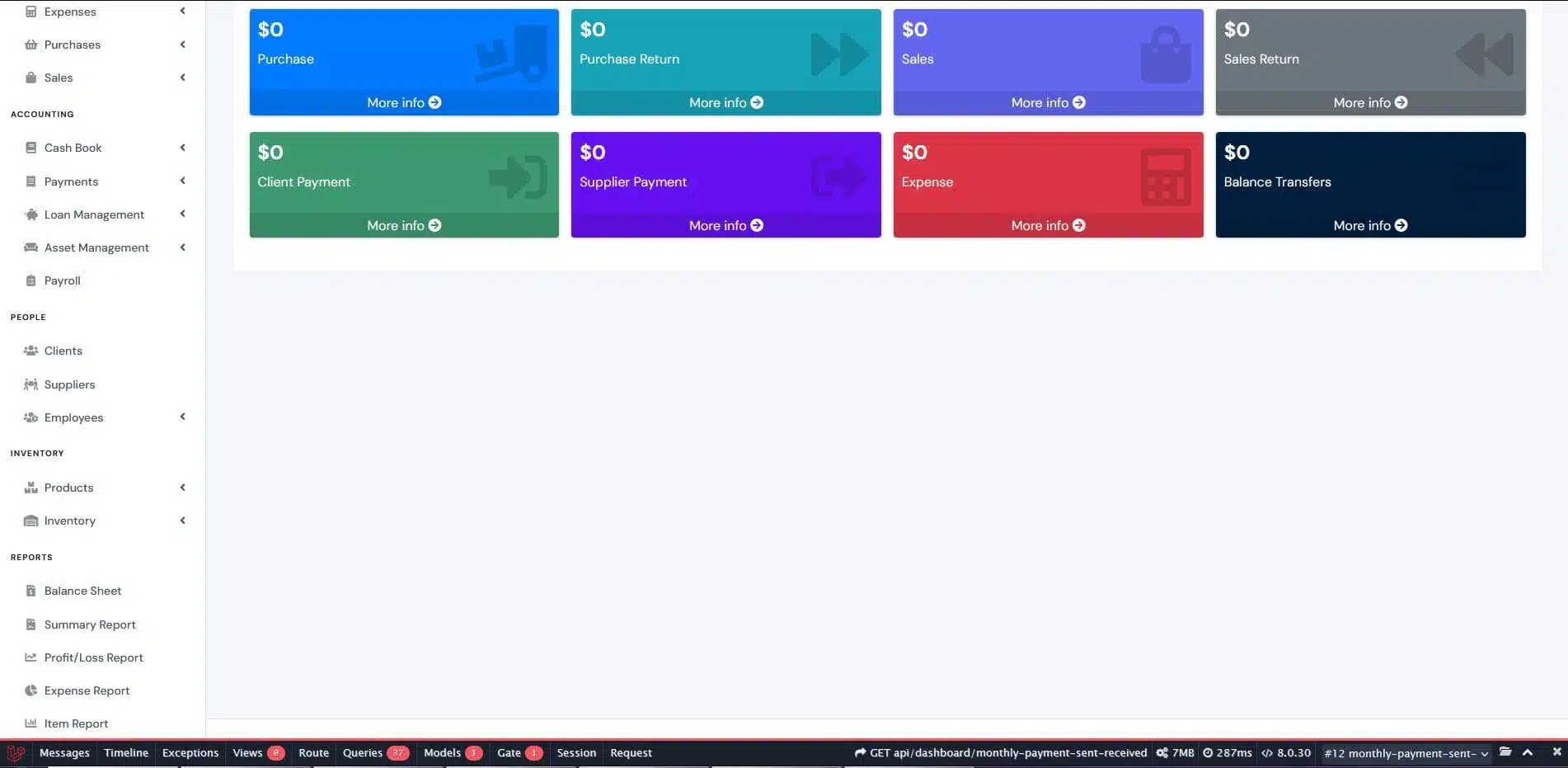

For startups and small businesses on a budget, accounting software free or free accounting software for small business options are available, such as Wave accounting software and SQL accounting software. These tools allow you to manage financial records without a hefty investment. You can even find accounting software free download options that provide core accounting features, ideal for businesses that are just getting started.

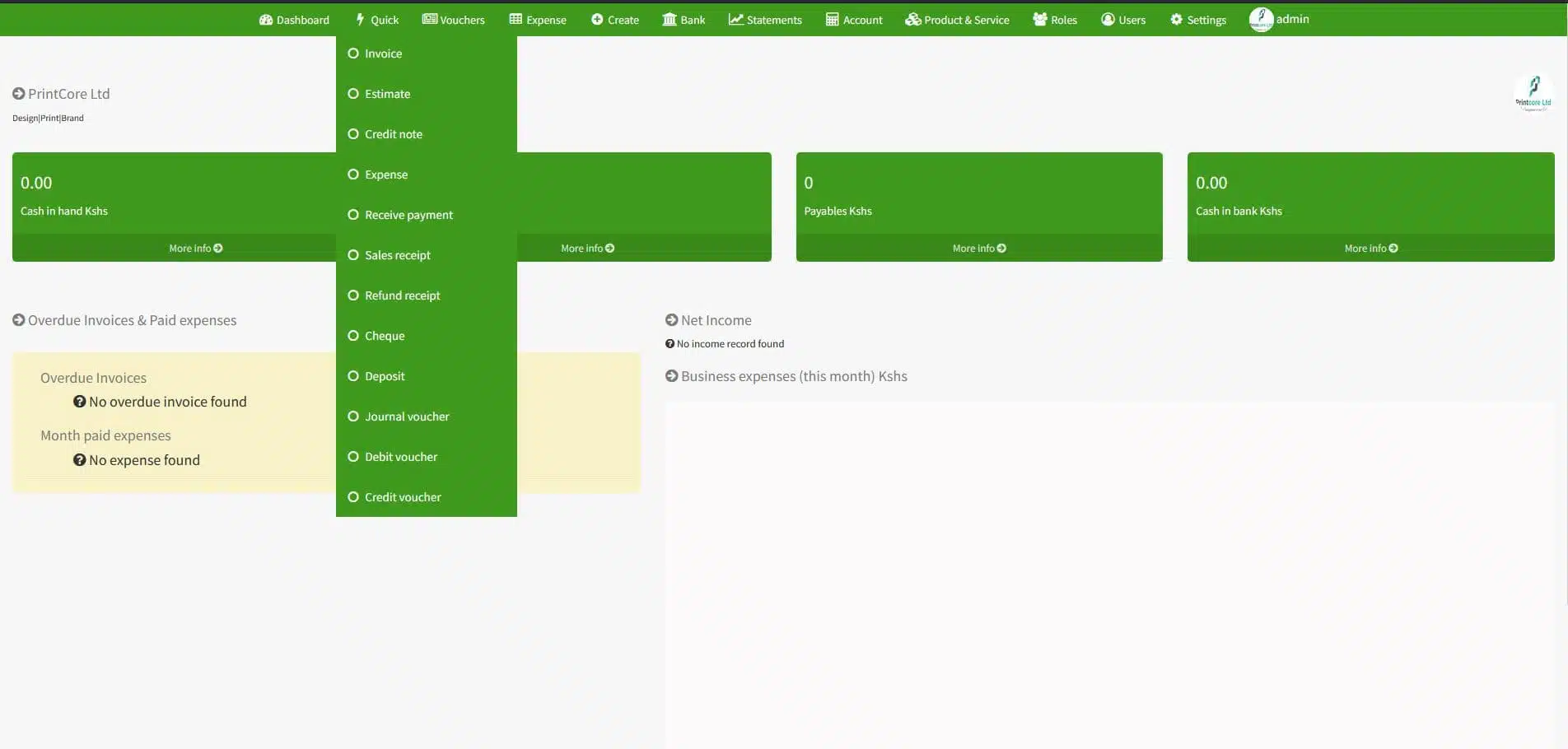

There are many different types of accounting software available, each tailored for specific business needs. Some accounting software examples include:

- Free accounting software: Wave Accounting, ZipBooks, and GnuCash

- Cloud-based accounting software: QuickBooks, Xero, Zoho Books

- ERP systems with accounting modules: SAP, Oracle, Microsoft Dynamics