What is Accounting Software?

December 12, 2024The Digital Banking Report shows that 85% of financial institutions now offer online loan applications. McKinsey also found that 50% of finance companies focus on digital development. If you don’t keep up with these technology trends, you risk being left behind by competitors who are embracing these changes.

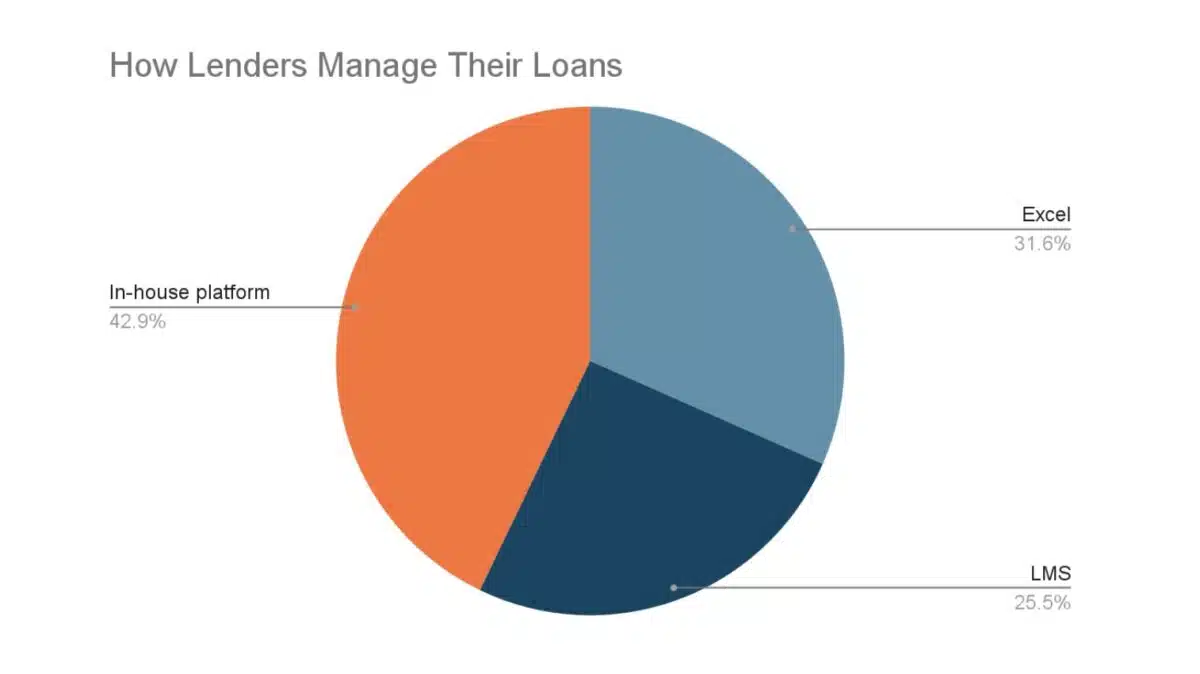

Migrating from Excel to Loan Management Software

In our own exclusive research – where we surveyed 250 CEO’s of digital lending businesses – we found that 31% of lenders still manage their loans with Excel.

What is Loan Management Software?

Loan Management Software (LMS) is a digital tool that makes lending easier and more efficient. It helps with everything from applying for a loan to paying it back. This includes tasks like loan origination, servicing, and collection, all done well.

The main goal of Loan Management Software is to make things run smoother and make customers happier. LMS allows lenders to better manage their loans, spot risks, and follow the rules.

Using Loan Management Software can change your lending business for the better. It makes things run smoother and can lead to better financial results.

Advantages of using Loan Management Software

- 3.5x more accurate loan decisions : Leveraging the power of AI loan portfolio assessment. It takes a few seconds to predict the probability of repayment and take a profitable decision.

- 2.5x faster loan processing : Loan processing automation to accelerate underwriting. AI automated loan approval system scores and preapproves applications, saving time of your managers.

- 90% fewer human mistakes : Replace manual data entry with auto-population of fields to eliminate human bias. Leave no space for human errors with lending process automation.

5 Types of Loan Management Software

Here are five main types that cater to different landing needs and can improve your lending strategies.

Commercial Lending Software

Commercial Lending Software helps with business loans. It has tools for checking risks, following rules, and making loans. With Commercial Lending Solutions, lenders can work better and make quicker decisions.

Consumer Lending Software

Consumer Lending Software makes personal loans easier to apply for and manage. It has user-friendly interfaces and strong back-end processing. Using Consumer Lending Systems can make customers happier and speed up loan approvals.

Auto Loan Management Software

Auto Loan Software is for financing cars. It helps lenders manage applications, approvals, and services. It includes customizable payment plans and reminders, which can keep customers coming back and make operations smoother.

Bridge Loan Software

Bridge Loan Software is used for short-term loans, often for real estate. It lets lenders quickly check properties, process applications, and set up repayment plans. This speed is key for taking advantage of market opportunities and meeting urgent financing needs.

Microfinance Software

Microfinance Software gives small loans to those with low incomes or groups, focusing on financial inclusion. It manages applications, payments, and checks for rules. Using this software makes loans more accessible and supports community growth.

Where can i view or download Loan Management Software ?

Here are the top 4 loan management software solutions that offer comprehensive features to meet the needs of various lending businesses in Kenya

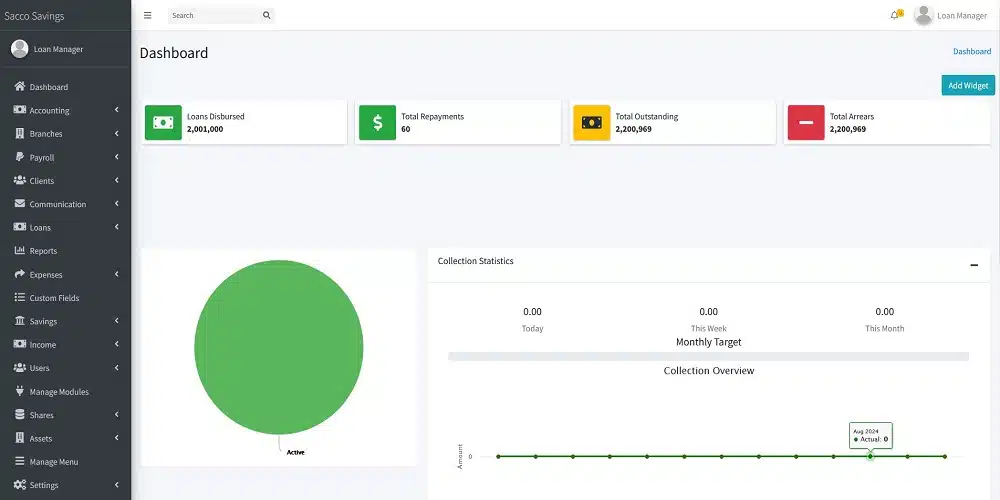

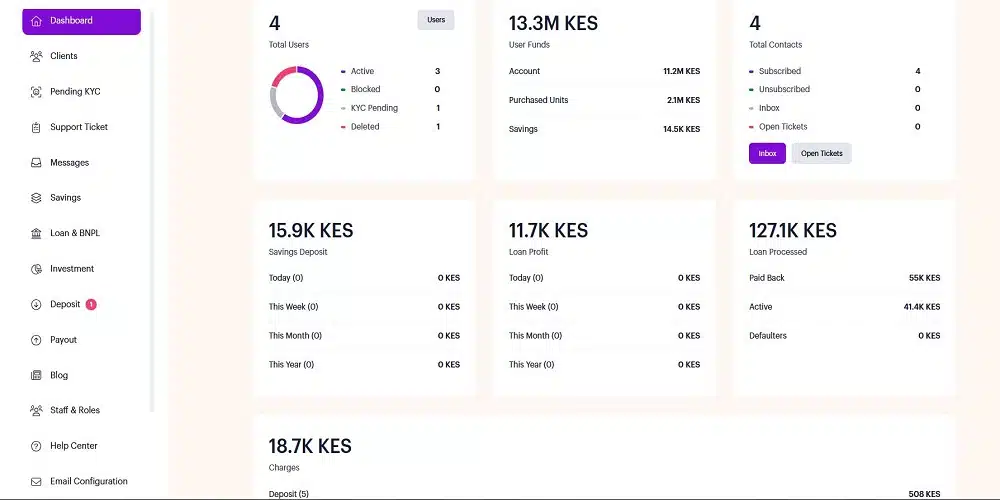

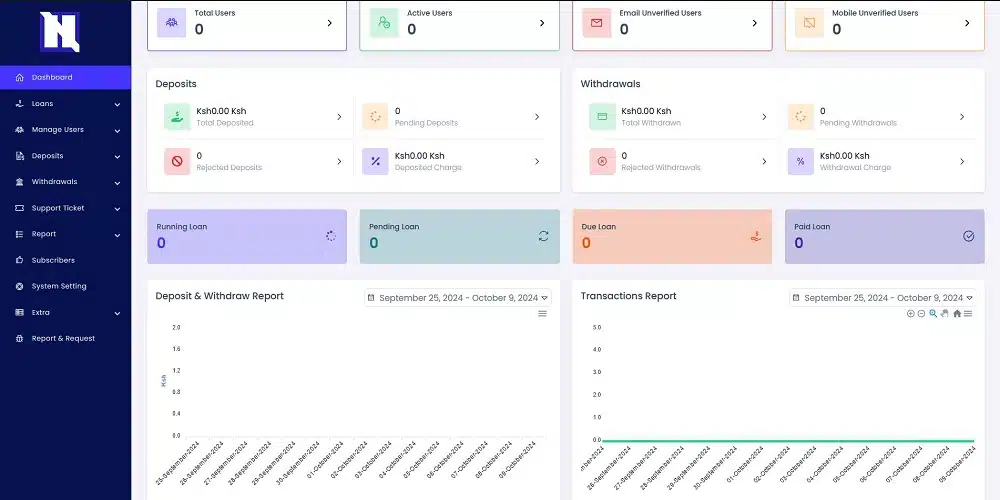

Loan Software Demo 1 ( Username: admin@gmail.com Password: 123456 )

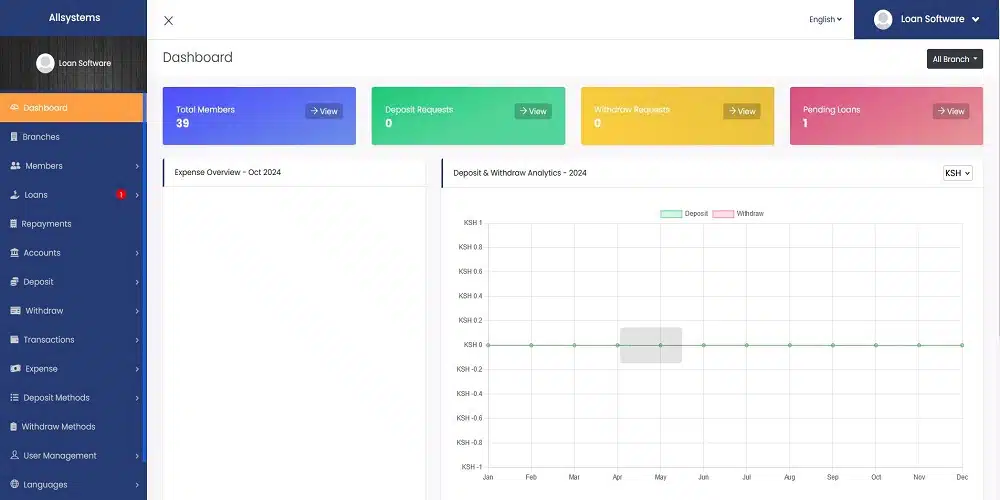

Loan Software Demo 2 ( Username: admin@gmail.com Password: 123456 )

Loan Software Demo 3 ( Username: admin Password: 123456 )

Loan Software Demo 4 ( Username: admin Password: 123456 )

Dashboard screenshots of Loan Management Software showing features

Wrap!

In conclusion, the top 4 loan management software for small lenders offer a diverse range of features and pricing options to cater to the specific needs of small lenders. From loan origination to servicing and management, these software solutions are designed to streamline the lending process and provide valuable insights through integrated analytics modules.